An investor needs to know about a broker before starting to trade with a new fx broker or any other trading platform. If you are planning to trade with Bank of Montreal, you should read this comprehensive Bank of Montreal review. Scam Help Center Team suspects Bank of Montreal as a fraudulent broker. Read the details here.

Website – www.bmosecurities.com; www.bmo-private.com

Website Availability – No

Address – NA

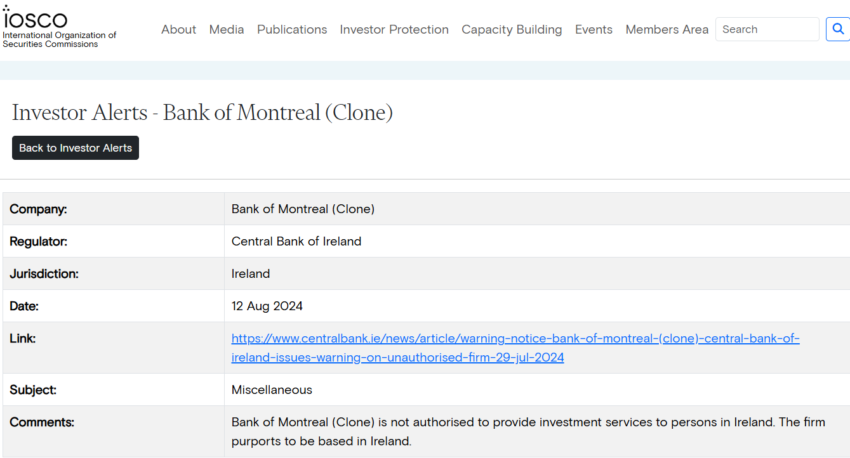

Blacklisted Status – Central Bank of Ireland (Ireland)

Domain Age Information –

- Name BMOSECURITIES.COM

- Registry Domain ID 2865436112_DOMAIN_COM-VRSN

- Registered On 2024-03-21T02:11:41Z

- Expires On 2025-03-21T02:11:41Z

- Updated On 2024-03-21T02:11:45Z

Fraudulent Conduct by Bank of Montreal Broker

The Bank of Montreal review uncovers a fraudulent scheme where an unauthorized entity falsely claims to offer investment services through its website, www.bmosecurities.com. This scam has cloned the details of the legitimate Bank of Montreal Europe plc, C27190, authorized by the Central Bank of Ireland, to deceive consumers. Importantly, the legitimate firm has no connection with the fraudulent one. The Central Bank of Ireland has issued warnings against this unregulated broker, confirming it operates without valid regulation. Victims report false promises, high-risk investment schemes, and significant financial losses. Warning signs include unrealistic returns, aggressive marketing tactics, and lack of transparency. Investors are urged to verify credentials carefully and avoid this scam, as highlighted in this Bank of Montreal review.

Red Flags and Negative User Reviews

A key aspect to consider when assessing Bank of Montreal’s reliability is the widespread presence of negative reviews across multiple online platforms. Many of these reviews highlight serious concerns, including difficulties with withdrawals, unresponsive or poor customer service, misinformation, and clear evidence of Romance fraud and other types of fraud. Such reviews present a troubling picture of the platform’s practices and raise red flags for prospective investors. The frequency of these negative experiences suggests significant risks associated with trading on bmo-private.com. Issues like these can severely undermine a trader’s confidence, highlighting the potential for financial loss or fraudulent activity. Therefore, it is highly advised that prospective investors proceed cautiously when dealing with Bank of Montreal. It may be wiser to explore more reliable and reputable forex trading brokers, particularly those featured on the genuine and trusted brokers list, to safeguard investments and avoid unnecessary risks.

Looking to invest safely? Choose a licensed and regulated forex brokers and avoid these fraudulent brokers 2024.

Importance of Regulatory Warnings

The most significant indicator of potential deceit is the lack of regulatory supervision, either completely or insufficiently. Regulatory bodies such as the SEC, FCA, FINMA, ASIC, BaFin, FMA, CONSOB, and others issue warnings against unlicensed brokers operating without recognized financial norms. Examine the regulatory warnings to confirm the legitimacy of Bank of Montreal’s operations and the safety of investor funds.

Having a regulatory license adds another level of safety for traders by guaranteeing that the broker complies with strict guidelines including sufficient capital, transparency, and ethical conduct. It gives investors a safety net in case of disagreements or misconduct, which is lacking when working with unregulated businesses. In a bmosecurities.com review, the importance of choosing a licensed broker is often highlighted due to these safeguards.

Why Should You Avoid Trading with Unauthorized Brokers?

Due to the high risks involved, trading on an unregistered broker’s platform is not recommended.

- Money might not be separated, which would make it more susceptible to loss in the case of the broker’s bankruptcy or financial mismanagement.

- Transparency is sometimes lacking in operations, which leaves traders vulnerable to false information and unstated costs.

- The entire trading experience is undermined by generally worse service quality, poor customer assistance, and antiquated trading systems.

- Selecting a registered broker guarantees compliance with regulations that protect investors and advance a safer and more open trading environment.

Other Fraudulent Activities of Bank of Montreal broker

Bank of Montreal seems not fair to the investors as they complain about the withdrawal issues, unfulfilled bonus policies, and other assured benefits

Bank of Montreal offers assets that are highly risky and result in huge losses for investors.

Bmosecurities.com sales staff continues to call the investors and force them to invest more and more money.

Conclusion- Is Bank of Montreal a fraudulent or legit broker?

Given the regulatory warnings and negative bmo-private.com reviews, this situation suggests it may be a potential scam. Investors are advised to exercise extreme caution and consider choosing forex trading platforms with proper regulatory licenses and a strong reputation in the trading community.

Concerned about potential deceit? Protect yourself from internet dating scams, romance fraud, and fraudulent brokers by getting a free consultation.

Got Scammed by Bank of Montreal? Scam Help Center Is Your Solution for a Refund!

It’s critical for Bank of Montreal victims to seek assistance from websites like the Scam Help Center. Recovering your money through a chargeback could be possible if you suspect dishonesty. You should act right away and take careful documentation in order to strengthen your case and accelerate your recovery.

Find out more about your chargeback rights and available solutions. Contact us for expert guidance.

Visit our Facebook page – Scam Help Center

Twitter – Scam Help Center